With Klarna, you get a seamless shopping experience with flexible payment options to help shopping work with your budget.

But, what about your budget?

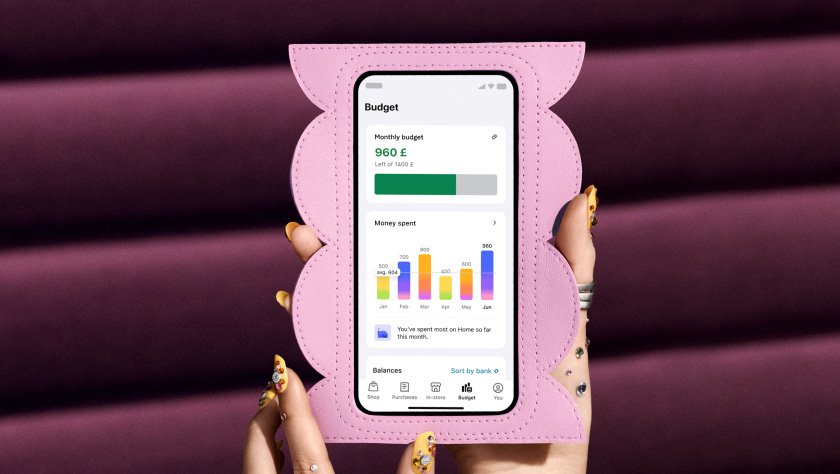

In the Klarna app, you can set a monthly budget on your Klarna spending. It uses a clear progress bar, so you can see with a quick glance how your spending stacks up against the budget limit you set for yourself. You’ll find it in your Klarna Money Manager.

The budget covers all you spend with Klarna, like shopping in the Klarna app, using Pay Later at an online store’s checkout, or tapping to pay in a physical store with the Klarna Card and Klarna Bank Card. Don’t worry, the amount is a soft limit — so it won’t stop you from buying something you need.

When you connect your other bank accounts to the Klarna Money Manager, all your expenses and income are aggregated in your budget. So, you can check one app to ensure the money going out doesn’t exceed your income.

Important: This tool shouldn’t be confused with your Purchase power. Your budget is how much you spend with Klarna. Purchase power is how much you can spend with Klarna.

The adjustable spending limit with the advantage of not blocking purchases makes this a flexible financial assistant that can fit into any budgeting system, if you already have one. It’s also a good place to start budgeting your spending.

For some inspiration, here’s how setting a budget in Money Manager works with the most common personal budgeting methods.

“Pay yourself first”

When you prioritize paying yourself first, you’re immediately setting aside a portion of your income for savings or debt repayment. With Klarna Money Manager, you can connect your bank accounts and set what’s leftover as your spending limit. You can track all your expenses and see if you’re staying within your budget.

It’s important to note that paying yourself first doesn’t mean treating yourself first. It’s about setting money aside for long-term savings or reducing debt. You can also allocate funds for short-term savings, such as a vacation or a new computer.

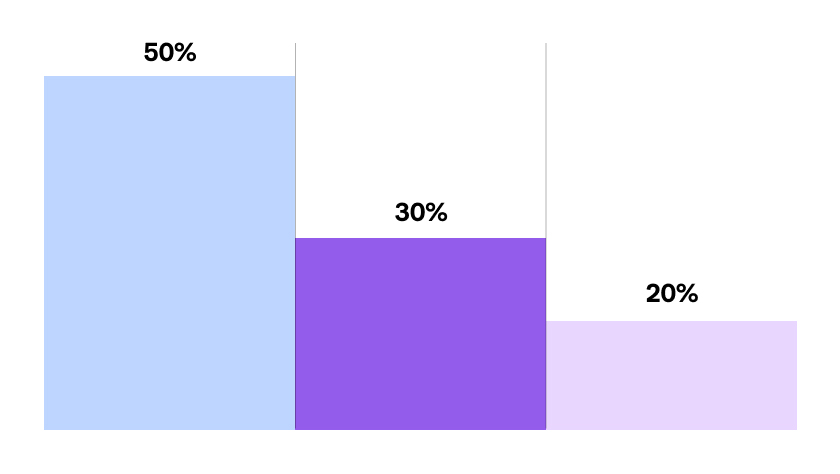

50-30-20

Want to get a little more precise about what you’re spending your money on? The 50-30-20 method takes its name from this budget breakdown:

50% for necessities like rent and groceries

30% for wants like entertainment and going out

20% for savings

Like paying yourself, you’d sock away your 20% savings and then set the budget to your spending.

If you do most of your ‘wants’ spending on Klarna, then just set your budget to 30% of your income and check regularly on how you’re spending your fun money.

If you connect your other bank accounts, then you can track all your spending, so go ahead and set your budget to 80% of your income and watch your progress to know if you’re spending within your budget.

Zero-based budget

This method is a good place to start when you don’t know where to start.

If you’ve connected your other bank accounts, then you can see all your expenses over the months in the Klarna Money Manager. It’s automatically broken down by category, so you can see where your money goes with clear helpful graphs.

By looking closely at your expenses from the last few months, you can set a realistic budget because it’s grounded in your own spending, which might make it more effective. Even if you haven’t connected your accounts, it’s a good approach for keeping your Klarna spending under budget.

Be kind to yourself: This approach isn’t about beating yourself up over how much you’ve spent in the past— it’s about understanding how you’ve spent your money so you can make smarter financial decisions now.

First, set a budget!

Start managing your finances today with a simple first step: setting a budget. Stay on track by regularly checking your progress and aiming to stay within your budget.

Often, it can be easy to lose track of where our money is going. By setting a budget and checking in on your progress, you’ll stay in sync with your finances.

So, whether you’re a pro budgeter or beginner, a zero budgeter or 50-30-20 fan, just taking a moment to check in on your spending and your budget ensures you don’t lose track of your spending. And that keeps you in control of your finances.