Klarna in society

At Klarna, our mission is to reimagine how consumers spend and save in their daily lives. We help people save time and money and reduce financial worry. With our focus on customer obsession and commitment to transparency and accountability at the heart of everything we do, we are proud to be a trusted partner to 93 million consumers and 675,000 merchants across 26 markets.

Our amazing talented people and innovative technologies enable us to deliver this mission and we believe that we are making a positive impact on society and helping to drive the global economy forward.

1. Who is Klarna

1.1 The payments network of the future

Klarna is a global leading AI-powered payments network and financial assistant that smooths commerce by offering fairer, more sustainable, innovative solutions. Our mission is to reimagine how consumers spend and save in their daily lives by providing a seamless and secure shopping experience that helps our customers:

Save time

Save money

Less financial worry

1.2 We’re a fast-growing consumer ecosystem

93m

active consumers

675k

merchants

$105b

gross merchandise volume

26

countries

Partnered with the biggest brands

Supported by leading investors

1.3 Everyone is using Klarna

People across the world are using Klarna for their everyday spending—both online and in-store, across all types of verticals and industries.

There is no typical Klarna consumer.

82%

of the adult population in Sweden were active Klarna consumers in 2024

$87

is the average outstanding balance per customer vs $6,500 for credit card users

99%

of consumers pay off their balance with Klarna

1.4 Klarna customers are:

Balanced in gender representation

In all stages of life

Of all educational backgrounds

Living in all areas

1.5 Klarna is much more than just BNPL

We are a regulated bank and have offered flexible payment options since 2017

People choose Klarna for multiple reasons

1.6 Our customers have one thing in common—a deep distrust of traditional banks

When asked “is Klarna a better option than a credit card?“, here’s what Klarna consumers said:

Resulting in high customer engagement levels compared to the industry.

95%

believe Klarna is a better option than a credit card.

93%

are active after 12 months.

1.7 And it is not just Klarna customers who resent old banks

54%

global trust level in the financial services industry—bottom of all in 2022

81%

of US consumers aged 18-34 would prefer fintechs over legacy banks

63%

of people don't entirely trust their banks to handle their data responsibly

2. We’re on a mission to smooth commerce

2.1 Banks’ original purpose was to promote trade

By facilitating the exchange of goods, early banks played a pivotal role in helping markets become more efficient.

2.2 However, the industry has lost touch with its original purpose

Evidence shows that banks have had the wrong priorities

Often at the expense of customers’ well-being

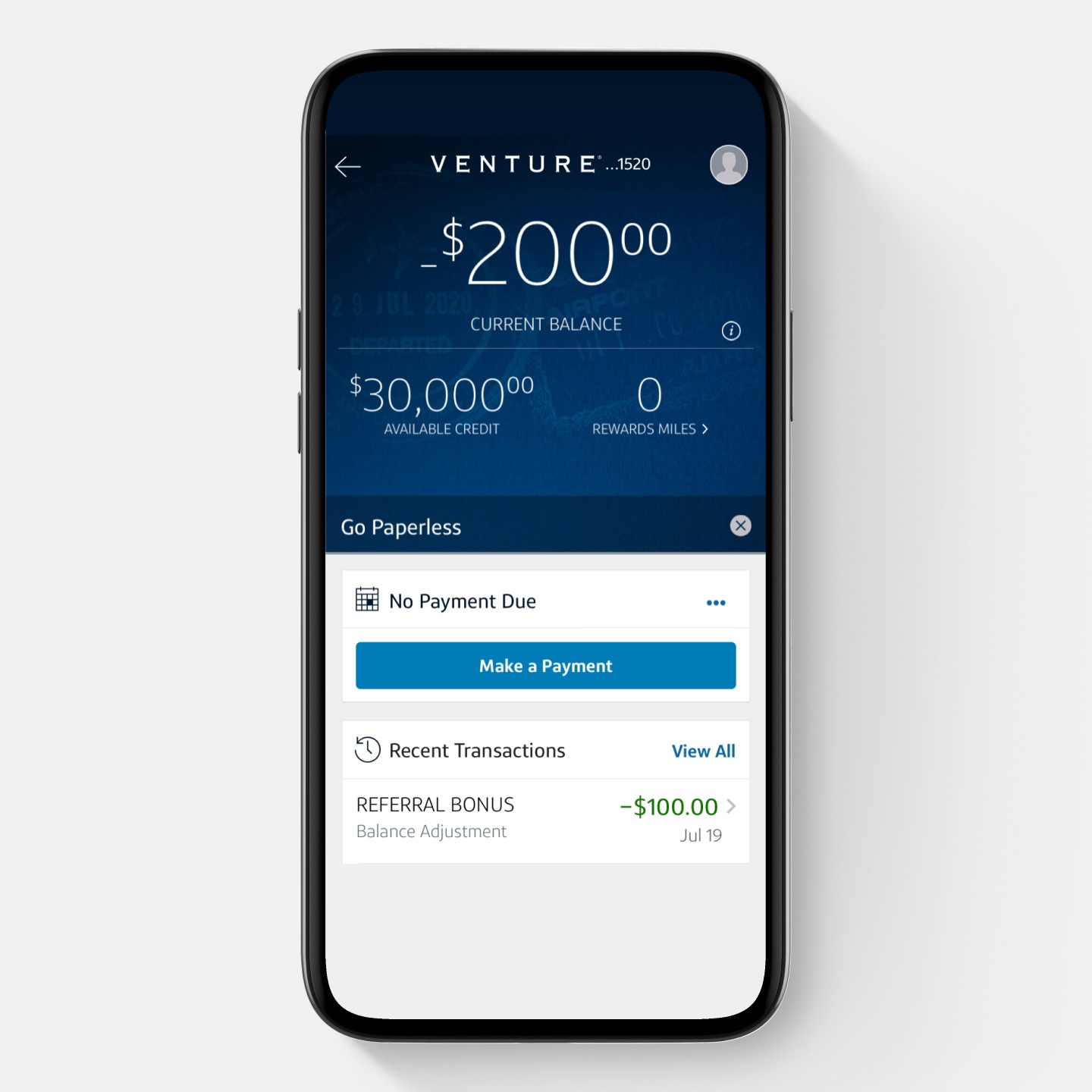

2.3 Contributing to the widening wealth gap in society

Incumbent banks and credit cards have paved the way for the greatest redistribution of wealth, where low-income households and the unbanked pay more but don’t benefit.

35 people pay $21

Lowest income households paying more to subsidize costs and fund credit card rewards.

1 person receives $750

Credit card benefits paid out to high-net-worth household in cash back and reward points.

3. Making markets smooth

Klarna is taking on the trillion-dollar retail banking industry to return to the original purpose that the traditional players have stepped away from - to promote and smooth commerce while putting consumers at the heart of what we do. With our suite of innovative products and services, we solve real problems for consumers and retailers and continue to ensure markets remain efficient while our customers remain satisfied. Not too bad for an old invoice company from Sweden. We empower our customers through solutions that offer:

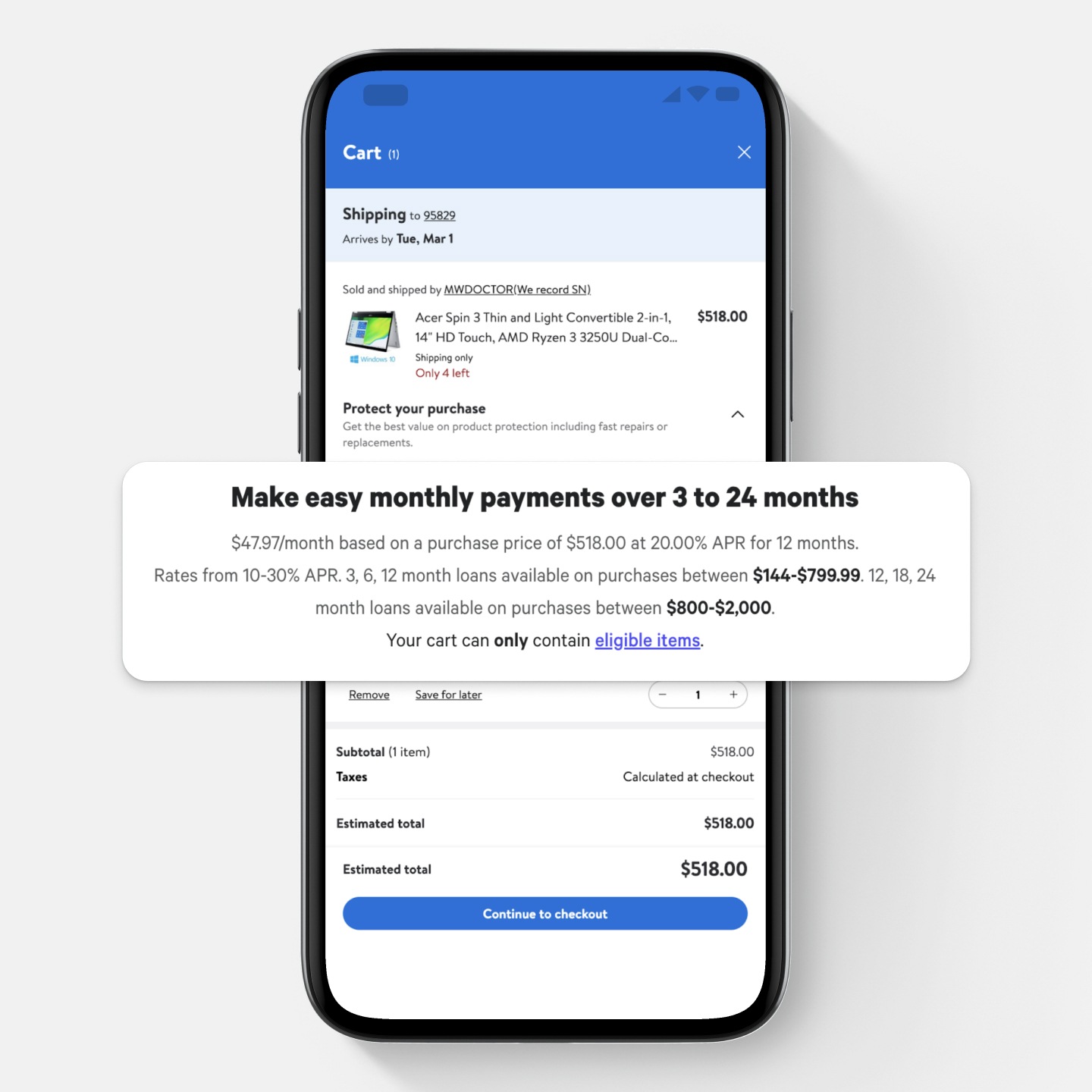

3.2 Credit at the lowest possible cost

Without Klarna

Predatory credit terms incentivized for profitability at the expense of consumers’ well-being.

29.9% point of sale APR

Average outstanding balance of $6,730

$5.50 — society pays to credit card providers for every $100 spent

With Klarna

We offer healthier payment options with full transparency and choice — no dirty tricks.

0% APR on BNPL products

Average outstanding balance of $100

Up to 60% lower costs society pays to Klarna for every $100 spent

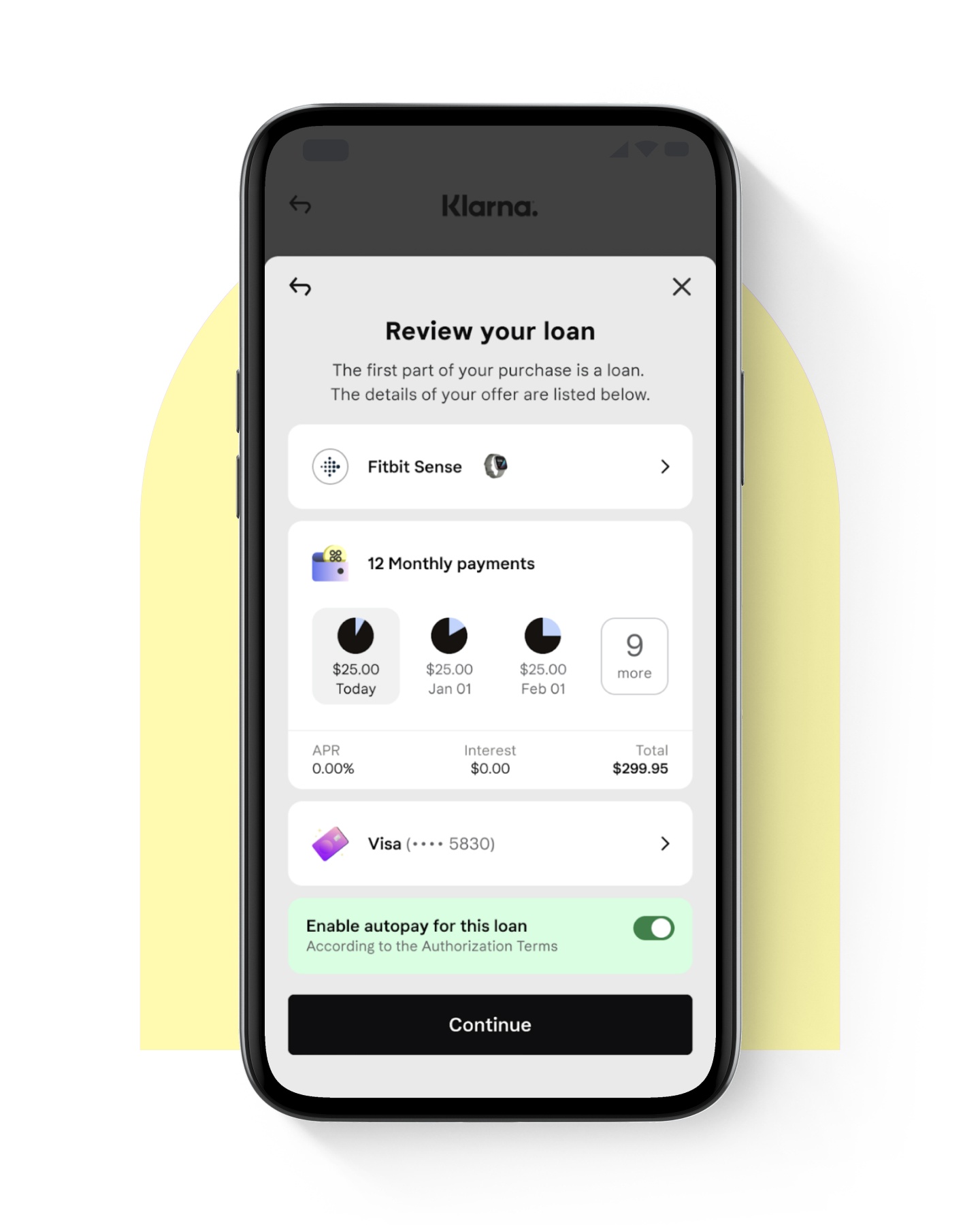

3.3 Dynamic underwriting for sustainable lending

Without Klarna

One-off underwriting when consumers sign up, optimized by banks for their own profit.

Single underwriting decision doesn’t account for changing financial circumstances

Sky-high credit limits for new customers to drive unhealthy consumption

Automatic credit limit increases to promote usage

Encourages minimum repayments and allows cash withdrawals and balance transfers

Poor customer insights from legacy systems that rely on out-of-date data

With Klarna

Dynamic underwriting optimized for sustainable lending that puts the consumer first.

At every purchase: A new real-time underwriting decision for every transaction

Small limits on 1st buy: New consumers start with small credit limits

Gradual credit limit increases: subject to repayment history, with account frozen if payments are missed

Fixed dates/amounts: Credit for specific purchases with clear repayment terms, fixed and short-term. Consumers can’t borrow in cash

In real-time: Combines credit bureau and internal insights with open banking data to build a real-time view of a consumer’s financial position

Through our dynamic and more effective underwriting, we’re able to pass on savings to both retailers and consumers by providing credit at the lowest possible cost.

99%

repayment rate globally

35%

lower consumer and fraud losses than credit cards in mature markets

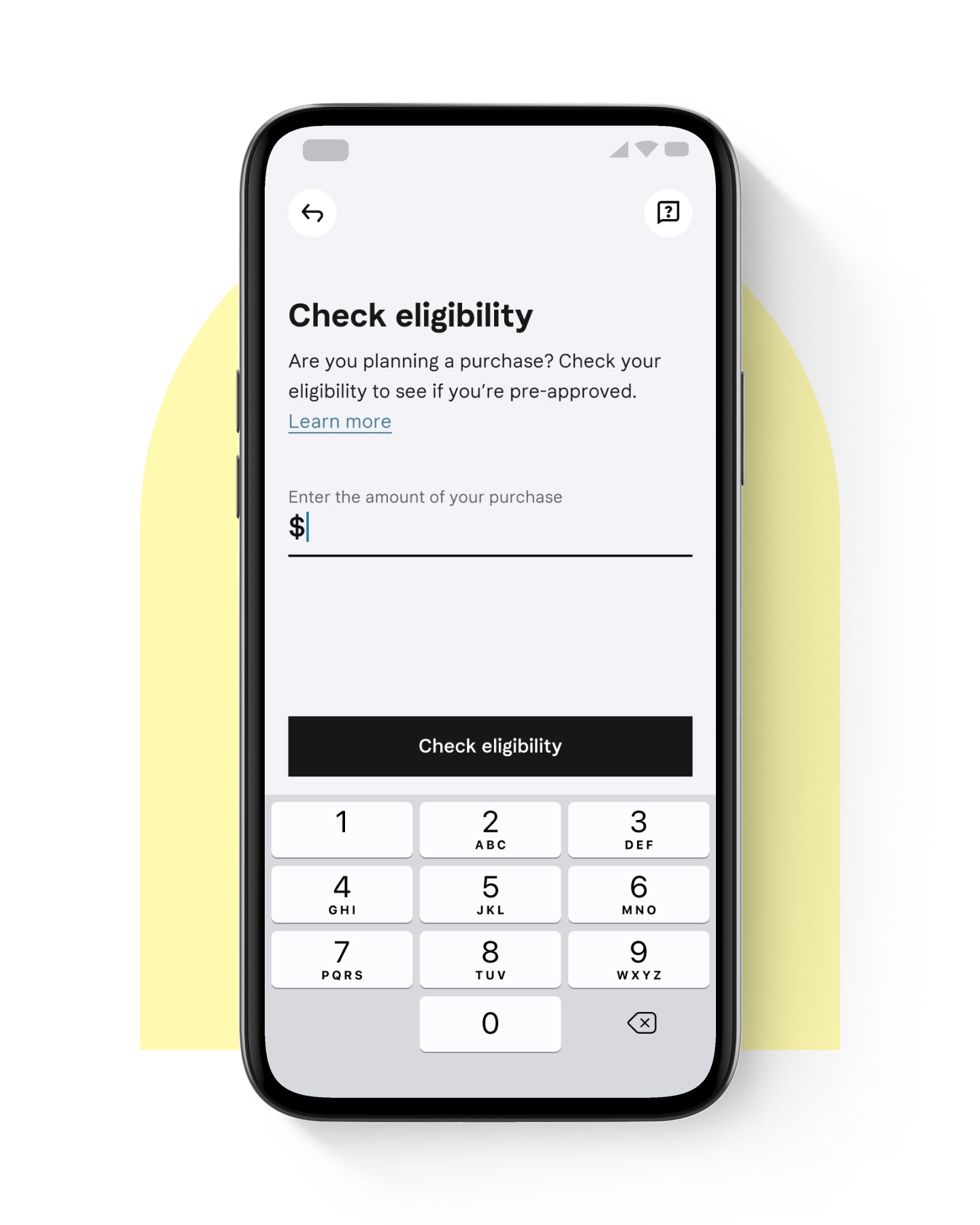

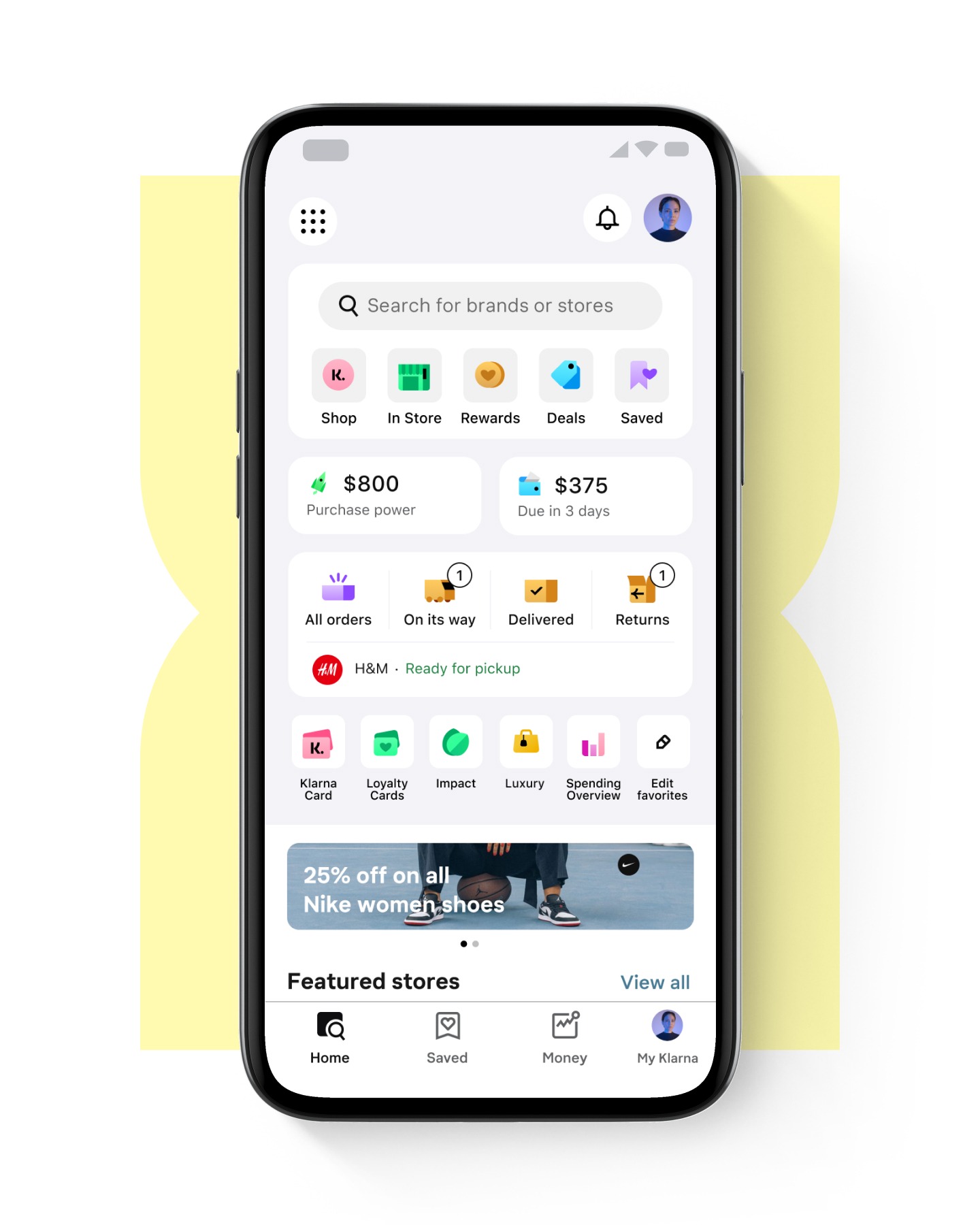

3.4 Simplifying consumers’ everyday lives

Without Klarna

A different app for each task.

With Klarna

With all tasks in one place, we’re reducing clutter for consumers.

3.5 A seamless user journey at no added costs to retailers

Without Klarna

A fragmented user journey when searching for card statements that charges retailers for customers they already have.

Retailers spend on average $0.2 per click on branded search ads

With Klarna

Statements with SKU-level data allow consumers to engage with their favorite brands again and again, at no added cost to the retailer.

Est $10m in annual savings in retailer ad spend

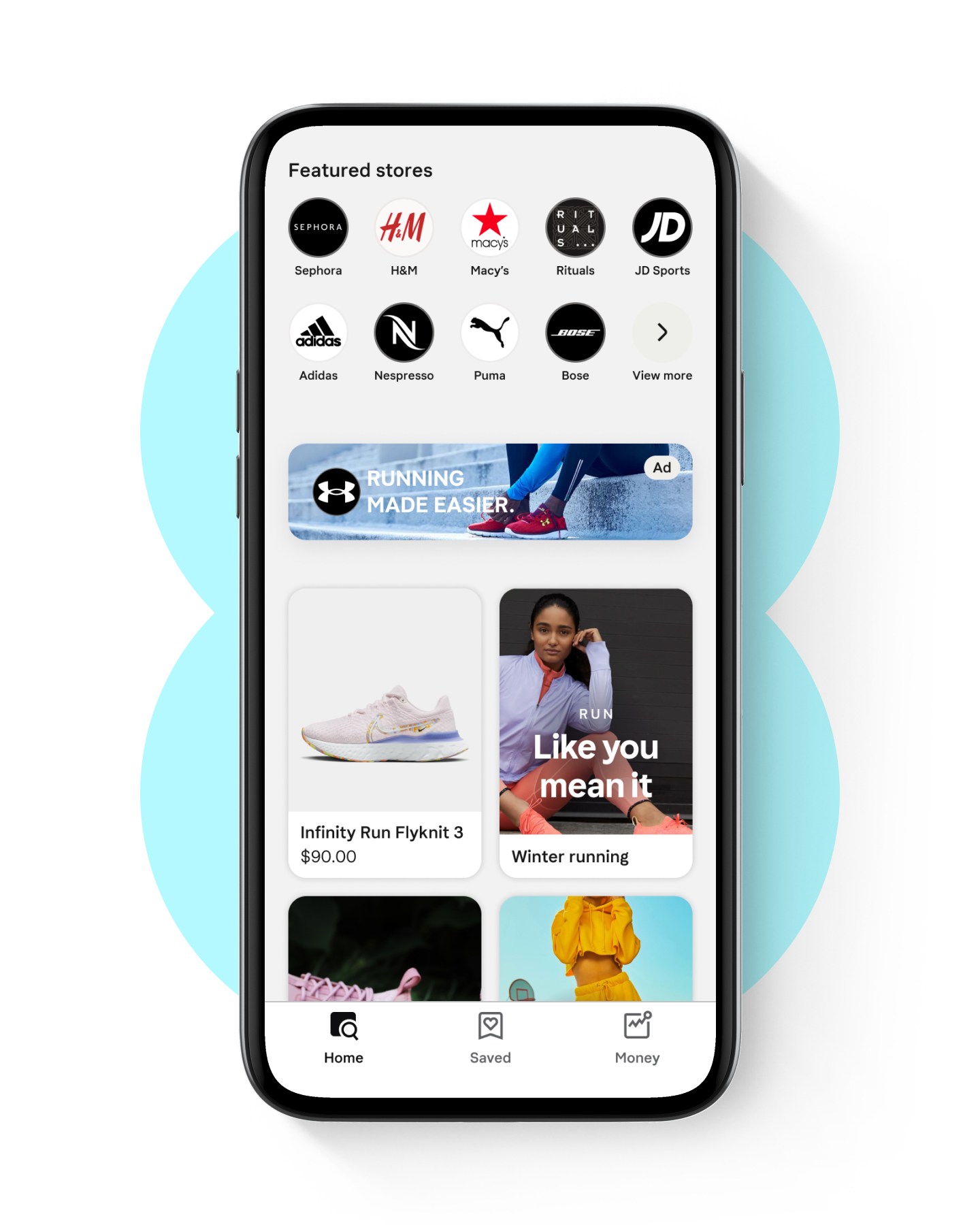

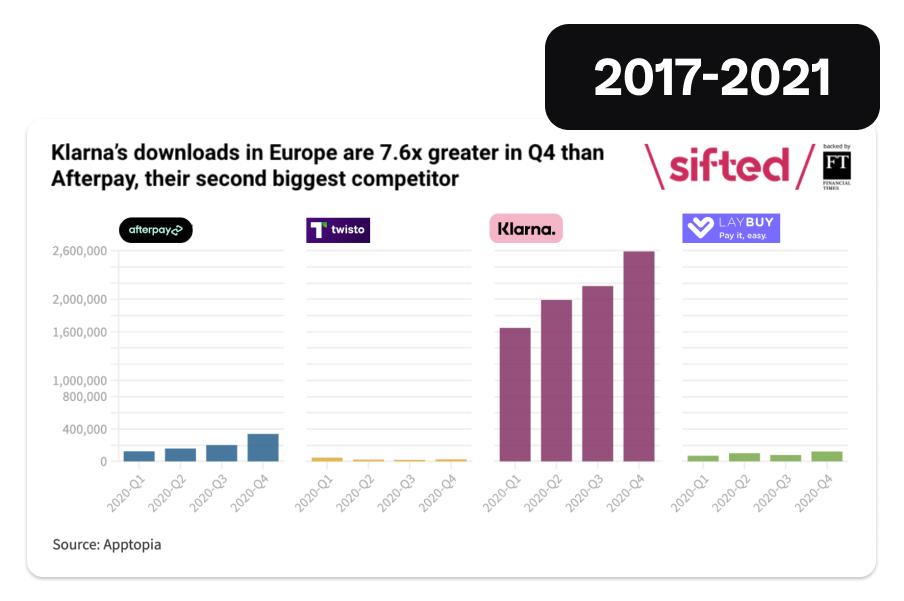

3.6 We’re the network of choice

And we will continue to deliver better consumer and retail partner outcomes, to build preference and power our long-term growth.

For consumers

40%

more app downloads than our closest competitor

2x

retention rate compared to industry standards

93%

of consumers are active after 12 months, versus 55% of credit cards

And retailers

5x

growth in number of merchants since 2018

49

of the US top 100 retailers choose us as their partner

835m

leads sent to retailers in 2023

4.1 We know what consumers value

Without Klarna

Irrelevant ads that make no sense

An experience/product that causes worry and stress

Impersonal treatment with no concern for your well being

With Klarna

Truly relevant and interesting ads

A tailored experience that suits you

The same familiarity of your favorite local restaurant or corner shop

4.2 A great matchmaker that builds long-lasting relationships

We have a deep understanding of the digitally transforming market, its players and their needs, and can turn that into great offers and services with our state-of-the-art technology.

Masterful matchmaking for better retention

Building valuable, long-term relationships between consumers and retailers

Assisting brands and products to better understand their customers

Delivering superior pre- and post-purchase experiences across channels

Supporting local businesses to become global

Allowing consumers to own their data and maximize its value across the ecosystem

5.1 Big Tech has exploited its power similarly to banks

They misuse consumer data, exploiting and locking them in

79% of frequent internet users agree that companies don’t allow them to control their own information.

They extort fees from retailers who have no choice but to buy their service

14% higher Google Shopping prices than other comparison services.

The result? Trust is undermined.

87%

of US consumers don’t trust Big Tech. Source: PR Newswire

66%

of small business owners say large corporations, such as Amazon and Google, have a negative impact on their growth opportunities. Source: Lendio

5.2 We know trust is built on honesty

We are huge in Sweden where we are now part of people's everyday lives, but our journey there has taught us much.

Just another digital payments solution

We started off by following a simple recipe: Make online shopping easier and safer; Drive online sales; Replicate old banks’ lucrative business models.

Becoming the change we wanted to see

We realized the industry’s practices were not aligned with customers’ best interests, so: Our first approach was to be honest about it. Our second approach was to transform the industry.

Competition pushed us to be better, faster

The road was challenging and change was slow - there was nothing driving us forward! It wasn’t until some worthy opponents appeared that we were able to pick up the pace and transform our entire business.

We have learned from past mistakes and those learnings are now embedded in Klarna’s very DNA!

Customers always come first

If it’s good for your customer, it’s good for you.

If you’re big, you have to be nice

As you benefit from economies of scale and better margins, give that back to consumers with lower prices.

Promote and embrace competition

Both within and without, it will make you better, stronger, and more focused!

5.3 Finally, unlike ‘Big Tech’, we promote and reward data mobility

Without Klarna

Big techs gate-keep data under the pretense of protecting privacy. They then monetise this data, growing their profits at the expense of society.

With Klarna

We give consumers ways to securely share their data with partners, helping them understand what they are doing and that the whole ecosystem shares the rewards.

6. Driving better outcomes for consumers

6.1 Access is key

We firmly believe in consumer choice — the more options for consumers the better as studies suggest that limiting choice by restricting access can have dangerous implications and put consumers in harm’s way.

Well-functioning, competitive markets are the strongest force to grow societal value and bolster consumers’ access to healthier providers, by pushing industry players to improve their standards and the quality of their offering.

6.2 Regulation should set the guardrails

Not all providers are created equal so we need regulation — specifically outcomes-based regulation, which drives innovation and empowers consumers to safely access new products and services while protecting them from harmful industry practices and bad actors.

But balance is crucial as too much regulation has often led to unintended consequences that ultimately end up harming consumers.

Klarna has an increasingly profound impact on the world, and we constantly reflect on our responsibility and purpose to society, with our mission to smooth commerce as our Northstar. By challenging the industries we operate in, with a singular focus on serving our customer's best interests, we will continue to deliver real value to society. This is who we are. This is why we are.

All financials as of December 2023 unless otherwise stated.

Last updated: April 2024