Pay with Klarna, now as a card

Use Klarna at the newstand, store, or restaurant—everywhere Visa is accepted.

Everything you love about Klarna, everywhere

Unlock the features of the new Klarna Card, powered by Visa:

Pay right away, once a month, or over time

Shop abroad without exchange fees from Klarna

And no monthly fees

Klarna Card is a regulated credit product. Borrowing more than you can afford, or paying late, may make it harder to get credit. 18+, UK residents only. Subject to status. T&Cs and late fees apply. Representative APR 0.0% (variable).

How Klarna Card works

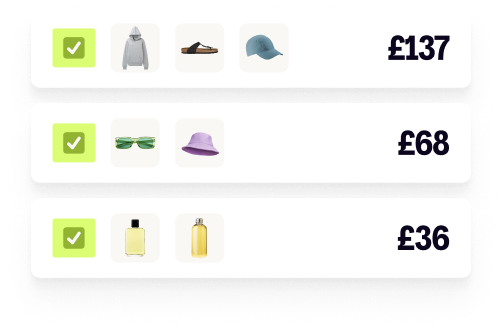

All your purchases are bundled to a monthly statement in the app, where you can pay purchases off automatically or manage individually.

Pay monthly, once a month

Pay off your whole balance once a month interest-free.

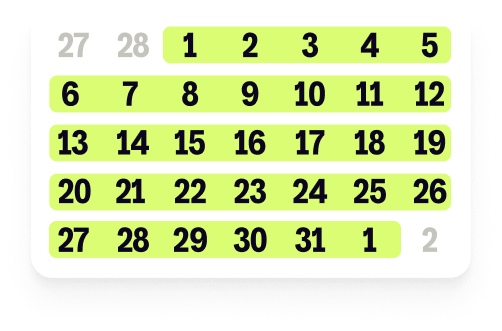

Pay next month

Need a little bit more time to pay? Extend the due date to the next month’s statement on purchases for a fee.

Pay over 3, 6 or 12 months

Make bigger purchases more manageable by spreading the cost. You’ll always know the amount to repay and if there’s a fee in the app.

Klarna Card is a regulated credit product. Borrowing more than you can afford, or paying late, may make it harder to get credit. 18+, UK residents only. Subject to status. T&Cs and late fees apply. Representative APR 0.0% (variable). If you want to spread a payment due under your Klarna Card, you can convert it into a payment plan over 3, 6, or 12 months, to be repaid in monthly instalments. Interest is payable on conversions at a rate of 27.9% (fixed). Borrowing more than you can afford, or paying late, may make it harder to get credit in the future. Credit subject to status. 18+. UK residents only. Representative example: 27.9% APR representative based on a loan amount of £1,200 repayable over 12 months at an interest rate of 27.9% p.a. (Fixed). Monthly repayment of £127.90 and a total amount payable of £1,534.80. Total charge for credit £334.80. T&Cs apply.

Bye bye foreign exchange fees

Travel smarter with the Klarna Card shop abroad without any foreign exchange fees from Klarna. Book your next holiday and select your preferred payment option: now, monthly or over time.

Like a credit card, but not

Get flexibility without carrying over your balance and letting it grow. You’re in control with clear due dates in the app, and no monthly fees or interest when you repay your balance every month. If there’s a charge for other payment options, you’ll always know upfront.

Join millions already paying with Klarna

150M+

Klarna users worldwide

60M+

App users worldwide

Visa

Secured transactions

Get more from your Klarna Card

Together with the Klarna app, you can track purchases, manage your finances, and more.

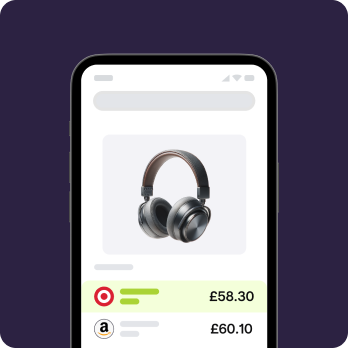

Find a great deal

Search and compare prices across stores. Get a great deal with Klarna Card at any store.

Track your spending

Track and manage all your finances easily, in the Klarna app with the Money Manager.

We have your back

Enjoy extra peace of mind with Buyers Protection when you shopping online. Limitations apply.

Questions?

Signup for the Klarna Card through the Klarna app. To be eligible for the Klarna Card, you need to meet the following criteria:

Be at least 18 years of age

Be a UK resident

Have purchased with Klarna at least once and repaid it on time

Pass the credit assessment, based on internal and external credit check

If you don’t see the possibility of applying for a Klarna Card, unfortunately it means that we can not offer it to you at the moment.

Please note: A hard check will be performed if you get the card. A hard credit check will appear on your credit history and might affect your credit score.

How much you can spend is reassessed on a real-time basis. You can view your current available amount to spend - Available Purchase Power - anytime in the Klarna App. It can increase or decrease over time depending on your repayment history and outstanding purchases with Klarna. Your Purchase Power takes into account all your purchases with Klarna - not just the Klarna Card - in order to give you more transparency and control over how much you can spend. You may reduce your limit below what we have offered you.

You can shop with the Klarna Card anywhere Visa is accepted. This means that you can shop safely with Klarna in stores and online. You can also use the Klarna Card abroad without additional exchange fee from Klarna.

You cannot use the Klarna Card to withdraw cash from an ATM.

Yes. There's Section 75 protection on eligible purchases made with your Klarna Card. It means you can apply for a reimbursement in some situations if something goes wrong with a purchase that was done with a Klarna Card. The purchase of goods or services must be between £100 and not more than £30,000 and weren’t paid for through an agent or third party.

Pay monthly or early - no interest.

Extend the due date on purchases valued between £15 and £300 to the next statement - a small fee will be added depending on the purchase amount (£0.50 - £4.99)

Late fees of £5 apply in case of missed payments. You can turn on Autopay and turn on reminders to stay on top of your payments.

Currency exchange - no Klarna fees. Use the Klarna Card worldwide, everywhere Visa is accepted —with no exchange fees from Klarna.

Klarna Card is a regulated credit product. Borrowing more than you can afford, or paying late, may make it harder to get credit. 18+, UK residents only. Subject to status. T&Cs and late fees apply. Representative APR 0.0% (variable).

Yes, a hard credit check is performed when getting the Klarna Card. This check will appear on your credit history and might affect your credit score.

We report your use of the Klarna Card to a Credit Reference Agency, called Experian.

Reporting will include missed purchases with any chosen repayment option in the app if the purchase was made with Klarna Card.

So if you pay us late, we may provide details of your late payment or failure to pay us to credit reference agencies, who may update your credit record accordingly. This could negatively affect your credit rating, making it more difficult or expensive for you to obtain credit in the future.

To avoid late payment fees and negative credit reporting, it's important to make your payments on time and in full. You can set up automatic payments to help ensure you don't miss a payment. Look for “AutoPay” in the Klarna Card settings in the App.

Yes, both Apple Pay and Google Pay are supported. It also works with your virtual and physical cards.

Bring some Klarna with you, on a card, everywhere

Take the Klarna Card shopping where Visa is accepted—then pay at the end of the month, extend due date, or pay over time. It’s up to you.