Wikipink

Wikipink is aimed at policy makers and the media to support an evidence-based conversation around BNPL.

Ten years in the UK

Klarna launched in the UK in 2014, inventing the modern BNPL market from a small rented office in Covent Garden. Credit card companies and traditional banks had been exploiting customers with sky-high interest rates and rip-off fees for too long.

Klarna is different. We are a global payments network and shopping assistant that offers fairer, more sustainable solution ways to access credit.

We provide a seamless and secure shopping experience that helps our customers save time, save money, and worry less.

After ten years in the UK, Klarna has been used by 18 million UK consumers and we liked London so much that we moved Klarna’s global holding company, Klarna Group Plc, here. The BNPL industry we helped to create is estimated to have saved British consumers £470 million in credit card interest payments in the ten years since Klarna entered the UK.

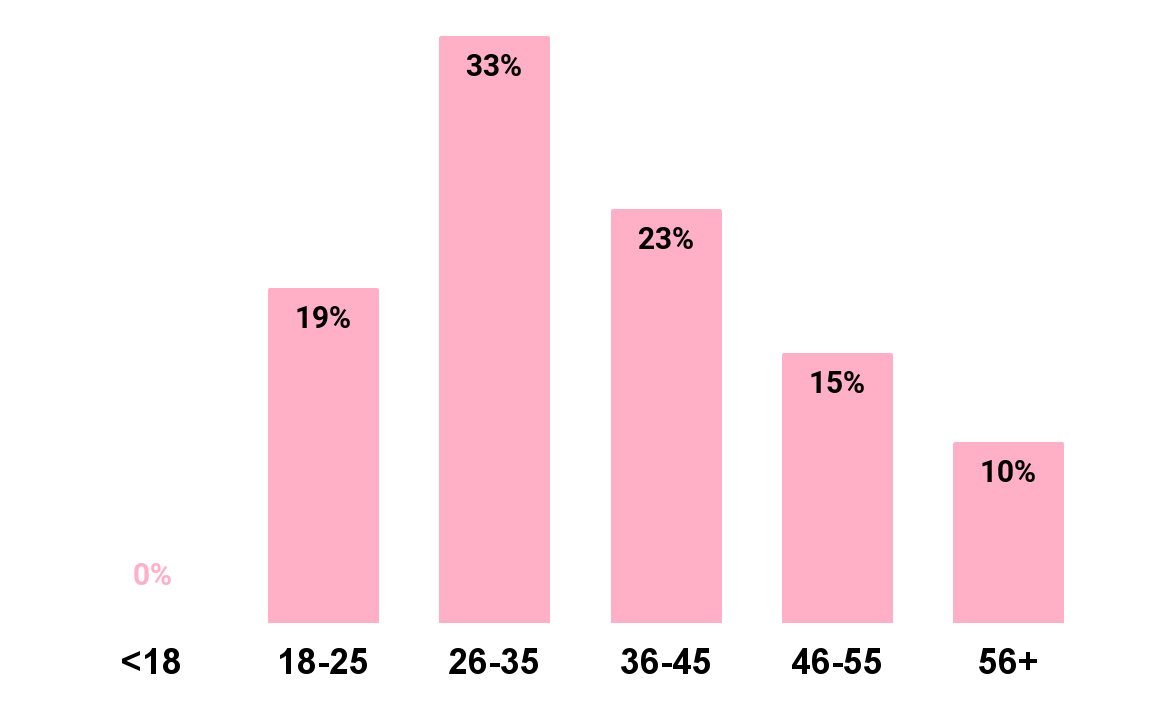

Here, we are publishing our facts and figures with full transparency, including age demographics, repayment rates, and late fee rates, to demonstrate that interest-free BNPL leads to better consumer outcomes than traditional credit. Where credit card companies had to be forced by the FCA to publish complaint rates, we are doing so voluntarily.

Klarna = a fairer alternative to spiraling credit debt

Klarna is well known as a leader in “Buy Now, Pay Later” but as the industry faces heavy criticism around offering predatory credit products to consumers, it is more important than ever for us to show how we are inherently different in our credit offerings from both the traditional financial services and the BNPL industry at large.

5% vs 50%

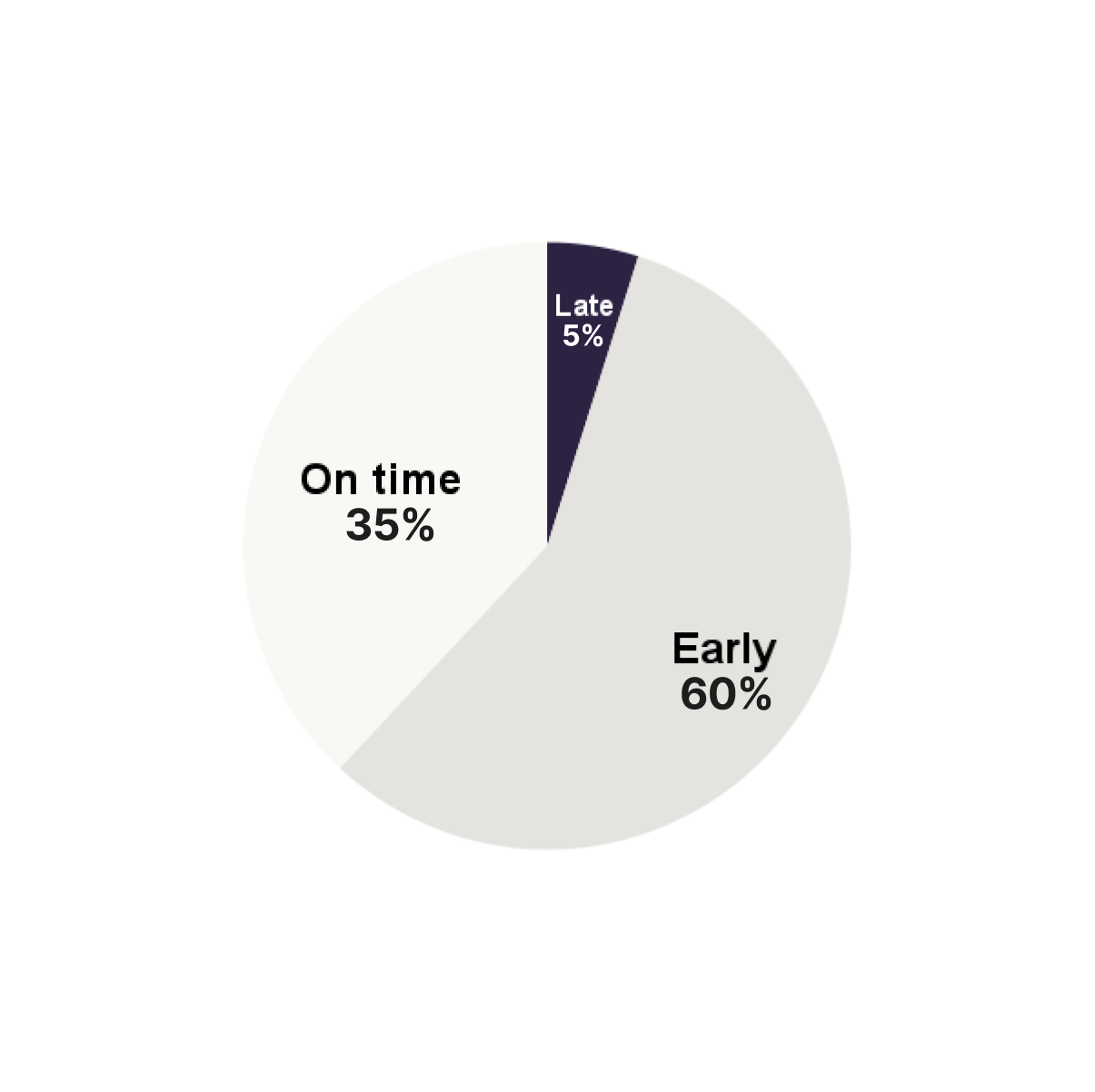

In 2023, 60% of Klarna’s interest free products were paid off in full early, 35% on time and just 5% were late. While credit card users struggle to pay off their monthly balance in full with half (50.1%) of credit card balances incurring interest.

£70bn

Outstanding credit card debt has increased by 9.2% and is now at an all time high at almost £70bn and with credit card interest rates at their highest in 27 years according to Bank of England data, UK consumers are looking for more sustainable payment alternatives.

0.4%

While the Bank of England reports that default rates for credit cards continue increase, Klarna’s default rate has never been lower at 0.4%.

Consumer debt is lower than ever

Ten years after Klarna launched BNPL in the UK, consumer credit relative to income is lower than ever.

According to the Resolution Foundation, Brits owe about 12% of their total disposable income, less than at any time since 2004.

Credit cards remain the biggest problem in credit, but brits are falling out of love with them

Credit cards are by far the biggest consumer credit product in the UK, used by 64% of Brits, followed by bank overdrafts. Over the past ten years, Brits have been slowing down their use of credit cards. As a result, credit card debt has fallen as a percentage of total consumer debt Brits spent £243bn on their credit cards in the year to May 2024 and 17% of UK consumers carry a credit card balance over from one month to the next, racking up interest (revolvers). This makes credit card companies a lot of money. They have charged UK consumers £63bn in interest in the past 10 years, and are one of the most expensive consumer credit products, accounting for 32% of outstanding balances but 39% of interest payments.

Share of adults holding credit card products (%)

Credit card balance share of net consumer lending

BNPL is better for consumers

On almost every measure, BNPL leads to better consumer outcomes than credit cards.

Credit cards make Brits spend more often and run up bigger debts than on BNPL. Consequently it takes four times longer to pay off a typical credit card debt and you are 40% more likely to fall behind on credit card payments.

This is because interest-free BNPL is a short-term loan, fully funded by the retailer. A BNPL provider maximises its revenue by lending money to people who will pay it back as quickly as possible, so it can lend that money out to another consumer.

So Klarna is incentivized to do everything they can to help consumers pay back on time, or even early.

A credit card company earns nearly all its revenue from consumer interest. It maximises its revenue by lending money to people who pay it back late, after the interest-free period has expired.

So credit card companies are incentivised to encourage consumers to delay repayments and make the minimum possible payment.

BNPL is helping consumers kick the credit card habit

For 44% of Brits, BNPL has helped reduced their credit card usage by ‘a fair amount’, ‘a great deal’ or ‘completely’.

The beginning of fair and sustainable payment methods

Since Klarna’s founding in 2005 and our UK launch in 2014 we have been redefining the shopping and payment experience making it more secure, transparent and frictionless for all our customers. Our business model is focussed on charging retailers, not consumers. We take our responsibility as a lender very seriously and have not waited for regulation of the BNPL sector before introducing a number of measures to help protect customers. This includes credit checks on every purchase, restricting the use of our services if repayments are missed, the first ever credit-opt out tool and reporting BNPL usage to credit reference agencies.

99%

Payments repaid

Less than one 1%

Default rate

60%

Pay us back early

Klarna's payment products

Pay in 3

Pay in 3 is our most popular product. It splits a purchase into 3 equal parts. The first part is paid at the time of purchase, the second after 30 days and the third after 60 days, no fee, no interest This is perfect when buying an unexpected but necessary item, like a replacement washing machine.

Pay Later

Pay later gives shoppers 30 days interest-free before they have to pay. It means consumers can try before they buy. It gives added safety to online purchases, customers do not have to release the money from their bank account until they have received the item.

Pay in full

Pay in full l aunched in 2021 and growing faster than any other product, is a super smoooth instant debit purchase offering customers the opportunity to pay at the time of purchase. Globally, pay in full accounts for over a quarter of our transactions.

Financing

Making up just 1% of Klarna purchases in the UK. Financing is Klarna’s answer to a more traditional regulated credit product for higher-ticket items. The majority of these payment plans last between 6-24 months. This is offered interest-free or interest-bearing depending on the retailer. Klarna's Financing plan has an APR ranging from 0-21.9%.

99% of transactions are interest free

Any late payment is a failure on us

It’s not in our interest to lend to people who can’t pay us back as it impacts our business negatively. We encourage on time payments with multiple reminders. We will send up to 4 reminders to a customer ahead of their payment due date. In that time customers can extend the due date of their payments for free which gives them 10 additional days to pay.

We’ll send a reminder on the day a payment is due and another reminder two days after a payment is missed. We may charge a late fee of up to £5 if any payment remains unpaid after 7 days, the total of late fees charged on an order will never exceed 25% of the total order.

We never charge more than two late fees per order. We will continue to send reminders. After 4 months we will tell the customer we will pass their order to a FCA approved debt collection agency who will attempt to make contact through phone, text, letter and email, the customer will no longer be able to use Klarna to make a payment.

Klarna's late payment statistics

In 2023, 95% of Klarna’s purchases were paid on time or early. Our late fee rates and debt collection rates are declining over time. This is a testament to Klarna’s business model and underscores our consumers pay responsibly and on time. While the banks report jumps in credit card defaults.

All age groups

Share of UK Pay in 3 orders which had a missed payment and may have incurred a late fee

All age groups

Share of UK Pay in 3 orders that have been referred to debt collection

All age groups

Share of UK Pay Later orders which had a missed payment and may have incurred a late fee

All age groups

Share of UK Pay Later orders that have been referred to debt collection

More than half of our orders are paid early

In 2023, over half (60%) of purchases were paid back early, 35% were paid on time, and 5% were late. In comparison half of UK of credit card consumers do not pay off their balance each month and incur interest.

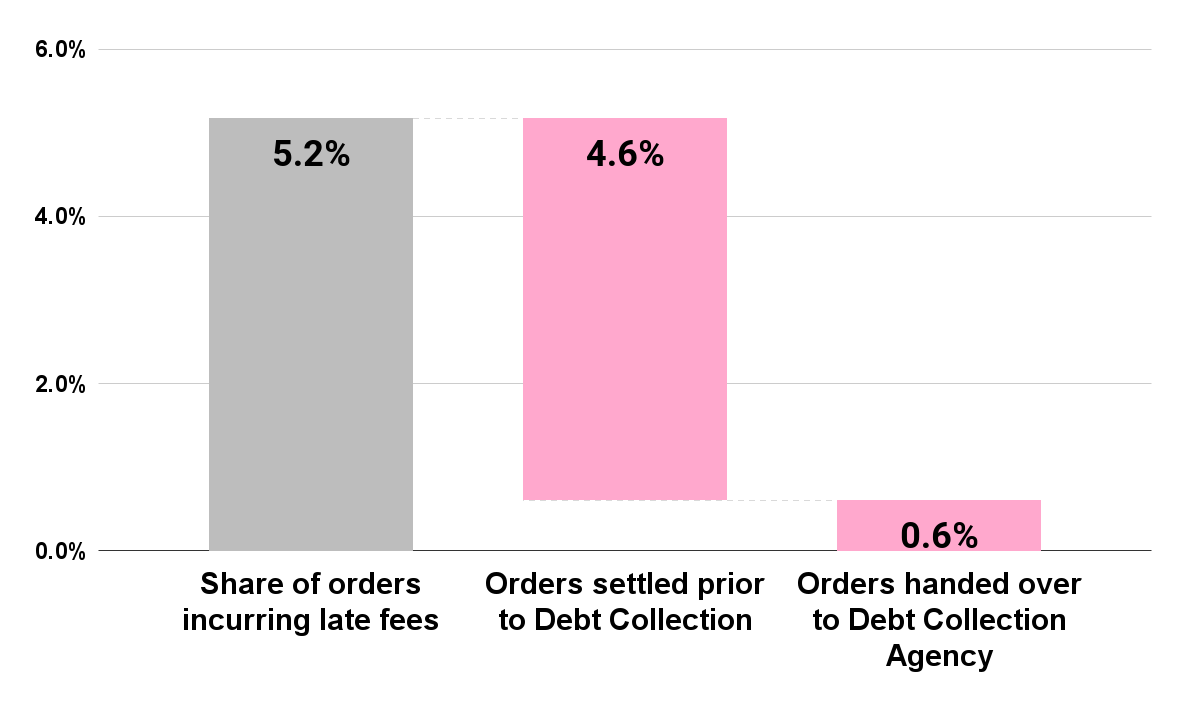

Just 0.61 % of orders are handed over to a DCA

In 2023, 5.18% of orders received a late fee, 4.6% of total orders were paid after receiving a late fee and 0.61% of orders were handed over to an FCA-regulated Debt Collector.

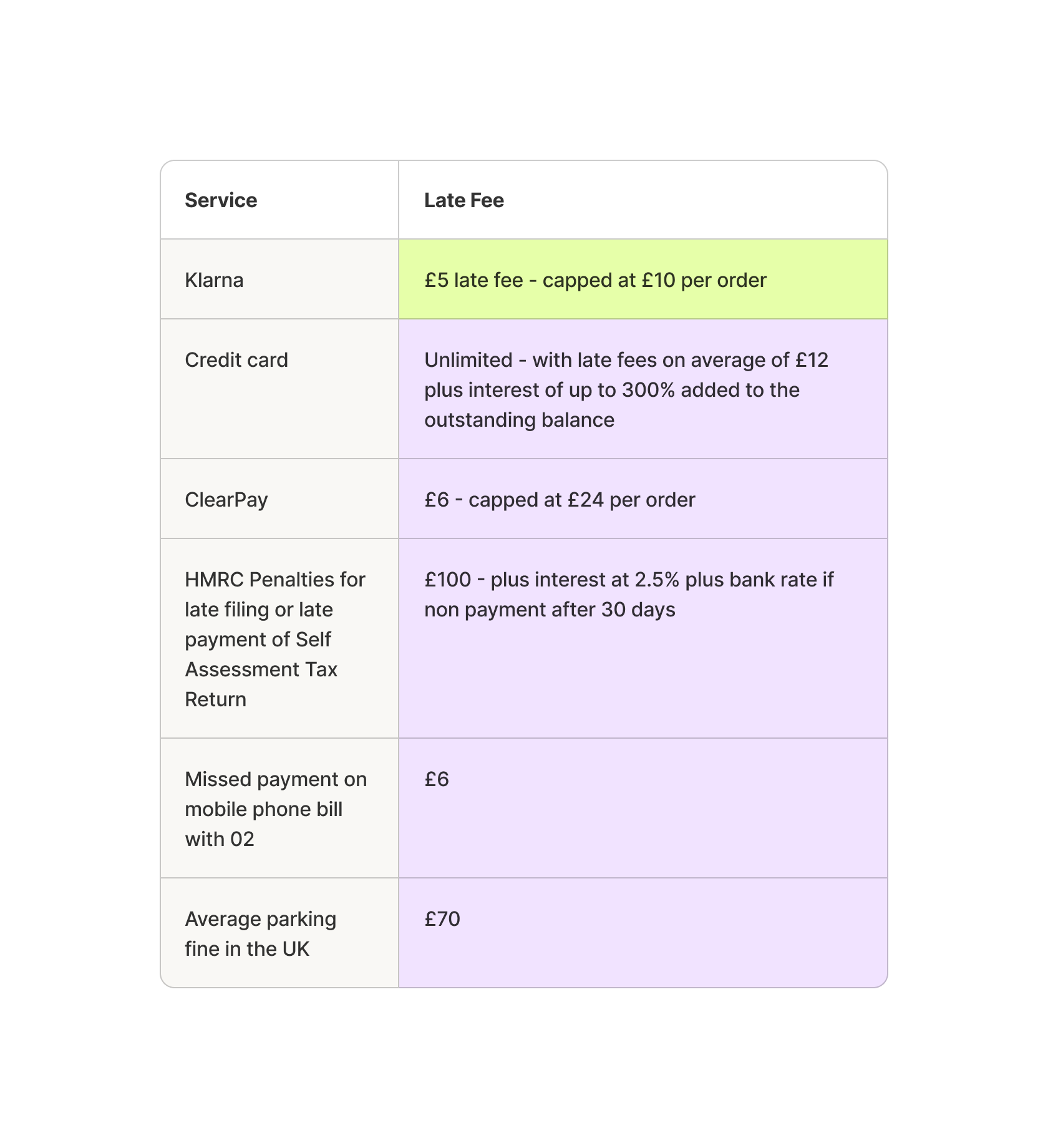

Late fees encourage on time payments

We charge the lowest late fees we can to ensure they act as a deterrent to missed payments, but that they do not become a large proportion of our income. That’s why our late fees are the lowest in the credit industry.

Credit card companies employ many dirty tactics to keep milking more and more money out of their customers

There is no typical Klarna customer, everyone uses Klarna

The average age of a customer in the UK is 36, and continues to trend upwards as consumers of all generations realise the benefits of BNPL.

Our consumers love us

Klarna is rated 4.1, Great on TrustPilot, traditional banks and credit cards can’t scrape past a 2. Don’t believe us? Take a look at

, ,Our complaint rate is 136 for every 1,000,000 transactions

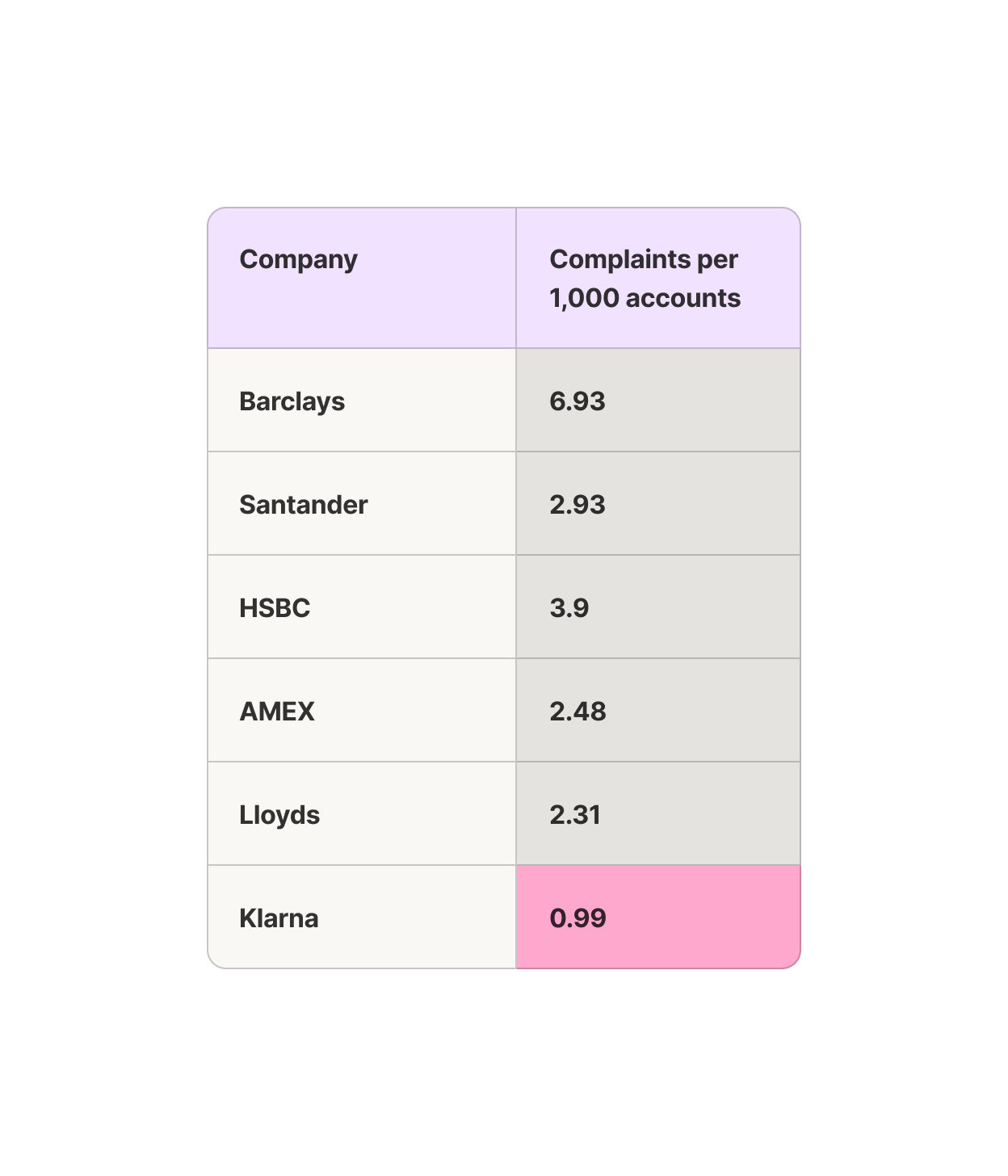

Traditional banks report complaint rates for credit cards and bank accounts to the FCA per 1,000 accounts. We’ve compared Klarna to some of the biggest credit card providers using the same metrics.

Sources

The stats on credit cards all comes from

The stat on credit card interest rates being their highest in 27 years is based on Bank of England data.

The stat on default rates for credit cards continue to increase comes from

.

The stats on consumer debt relative to household income comes from a report by the

.The stats on credit card usage over time comes from the Financial Conduct Authority's

(2022).The stats showing that BNPL is better for consumers comes from a Yougov survey conducted by Capital Economics for Klarna (available on request).

The stats showing that BNPL is helping consumers kick the credit card habit come from the same Yougov survey conducted by Capital Economics for Klarna (available on request).

All information comes from Klarna

All information comes from Klarna

All information comes from Klarna

The stat on the average credit card interest rate being 23.8% comes from Bank of England

The stats on credit cards all come from Money Charity see

."58% of users with a credit card, do not even know the interest rate on their credit card"

Data comes from Klarna UK Consumer Survey of 2,481 UK adults 30 March - 4 April 2023

All sources are linked to directly from the text

Stats from other companies than Klarna comes from the FCA