Get Klarna on a Visa card

Choose how you pay for every purchase—at a coffee shop, mall, or restaurant.

Shop anywhere Visa is accepted with no monthly or annual fees. Sign up in 60 seconds and start using it today.¹

Everything you love about Klarna, everywhere

Unlock the features of the Klarna Credit Card, powered by Visa:

Choose to pay in full, later, or in parts.²

Coming soon: convert payments to Pay in 4 with no cost.¹

Skip the service fee when you shop in the Klarna app.

Earn cashback in the Klarna app.³

No monthly or annual fees.

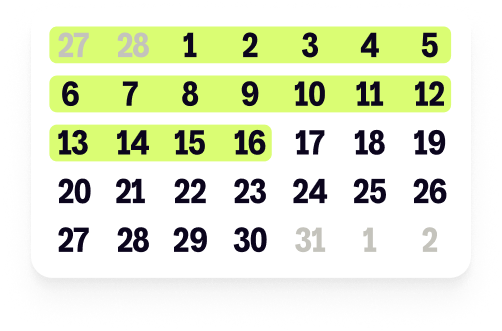

Coming soon: Pay in 4

Flex your budget like never before. Soon, you’ll be able to split your card purchases into 4 smaller payments every two weeks—giving you more control and a better fit for your budget.

How Klarna Credit Card works

With Klarna Credit Card, you’re in charge of managing your finances the smarter way. Pay straight away, later or over time - all managed in the Klarna app.

Pay later

All your purchases are bundled to a monthly statement that you pay once a month. Perfect for everyday buys.

Move to next month

Need a little bit more time to pay? Choose a purchase and move it to the next month’s statement.

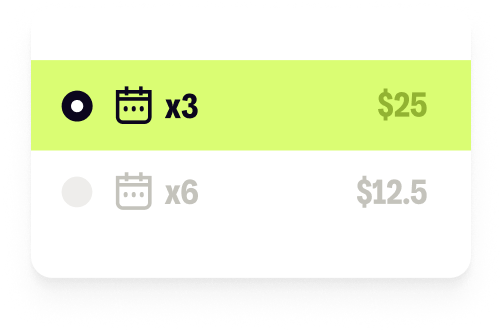

Pay over 3 or 6 months

Make bigger purchases more manageable by spreading the cost. You’ll always know the amount to repay in the app.

Earn cashback

Get up to 10% cashback when you shop in the app. That's real money added to your Klarna balance, ready for your next purchase in the app.³

Join millions already paying with Klarna

93m

Klarna users worldwide

4m+

users waiting for the Klarna Credit Card

Visa

Secured transactions

Smarter than the average credit card

Get flexibility without carrying over your balance and letting it grow. You’re in control with clear due dates in the app, and no annual fees or interest when you repay your balance every month. If there’s interest for other payment options, you’ll always know upfront.

Get more from your Klarna Credit Card

Together with the Klarna app, you can track purchases, manage your finances, and more.

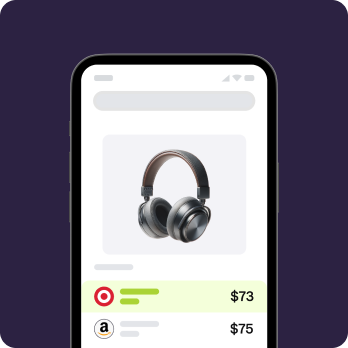

Find a great deal

Search and compare prices across stores. Get a great deal with Klarna Credit Card at any store.

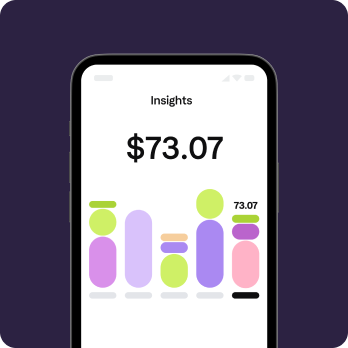

Track your spending

Track and manage all your finances easily, in the Klarna app with Money Manager.

Ask me anything

Ask the Klarna Credit Card AI assistant anything, and get the answers you need instantly.

Frequently asked questions

Sign up for the Klarna Credit Card through the Klarna app or website. Get your virtual Klarna Credit Card within minutes. It will be available to use right after it's created. You can add your virtual Klarna Credit Card to Apple Pay or Google Pay and start using Klarna anywhere Visa is accepted.

If at the end of sign up, you get a message saying that you are ineligible for the Klarna Credit Card, unfortunately, you can not get the card at the moment. Your eligibility status could change, so you can try applying for the Klarna Credit Card again in the future.

Eligibility requirements include:

Be at least 18 years of age.

Be a US resident.

Have purchased through Klarna at least once and paid on time.

Pass the credit assessment, based on a soft credit check.

The Klarna Credit Card is available in the 50 US states, plus the District of Columbia. It is not available in Puerto Rico, the US Virgin Islands, or any other US territories. Sign ups are currently unavailable in Wisconsin.

The amount that you can spend is reassessed on a real-time basis. It can increase or decrease over time depending on your repayment history and outstanding purchases. You can view your Purchase Power anytime in the

.⁴Yes, both Apple Pay and Google Pay are supported. It also works with your virtual and physical cards.

Bring some Klarna with you, on a card, everywhere

Take the Klarna Credit Card shopping where Visa is accepted—then choose to pay at the end of the month, the next month, or pay over time. It’s up to you.

¹ The Klarna Credit Card is issued by WebBank pursuant to a license from Visa U.S.A. A 28.99% APR applies to all moved or split transactions, except for Pay in 4, which is interest-free. Klarna Credit Card users can convert purchases to Pay in 4 within 12 hours of the transaction. The first payment is due immediately, with the remaining payments every two weeks over six weeks—interest-free. Pay in 4 is issued by Klarna Inc. CA resident loans are made or arranged pursuant to a California Financing Law License. NMLS #1353190.

² Monthly financing through Klarna issued by WebBank. Other CA resident loans made or arranged pursuant to a California Financing Law license. NMLS #1353190.

³ Earn cashback on Klarna App purchases. Klarna balance account required and funds can only be used within Klarna. Cashback issuance depends on store approval and may be affected by cookie settings, combining offers, product exclusions, or other factors beyond our control. Klarna may get a commission. Limitations, terms and conditions apply.

⁴ Purchase power is an estimate of how much you can spend. Subject to approval at the point of purchase and dependent on factors such as purchase history, payment history, and purchase amount.