Wikipink

The truth about Klarna in the US

Traditional credit providers are failing consumers. For too long, credit card companies and traditional banks have been exploiting consumers with sky-high interest rates and rip-off fees. The system is broken, and it will crack. Klarna is different. We are a global leading payments network and financial assistant that accelerates commerce by offering fairer, more sustainable, innovative solutions. We’re committed to providing a seamless and secure shopping experience that helps our customers save time, save money, and worry less. By publishing our facts and figures with full transparency, including age demographics, repayment rates, and late fee rates among others, we’ll demonstrate that interest-free BNPL leads to better consumer outcomes than traditional credit.

An alternative to spiraling credit card debt

Klarna is well known as a leader in “Buy Now, Pay Later,” but as the industry faces heavy criticism around offering predatory credit products to consumers, it is more important than ever for us to show how we are inherently different in our credit offerings from both the traditional financial services and BNPL industry at large.

41%

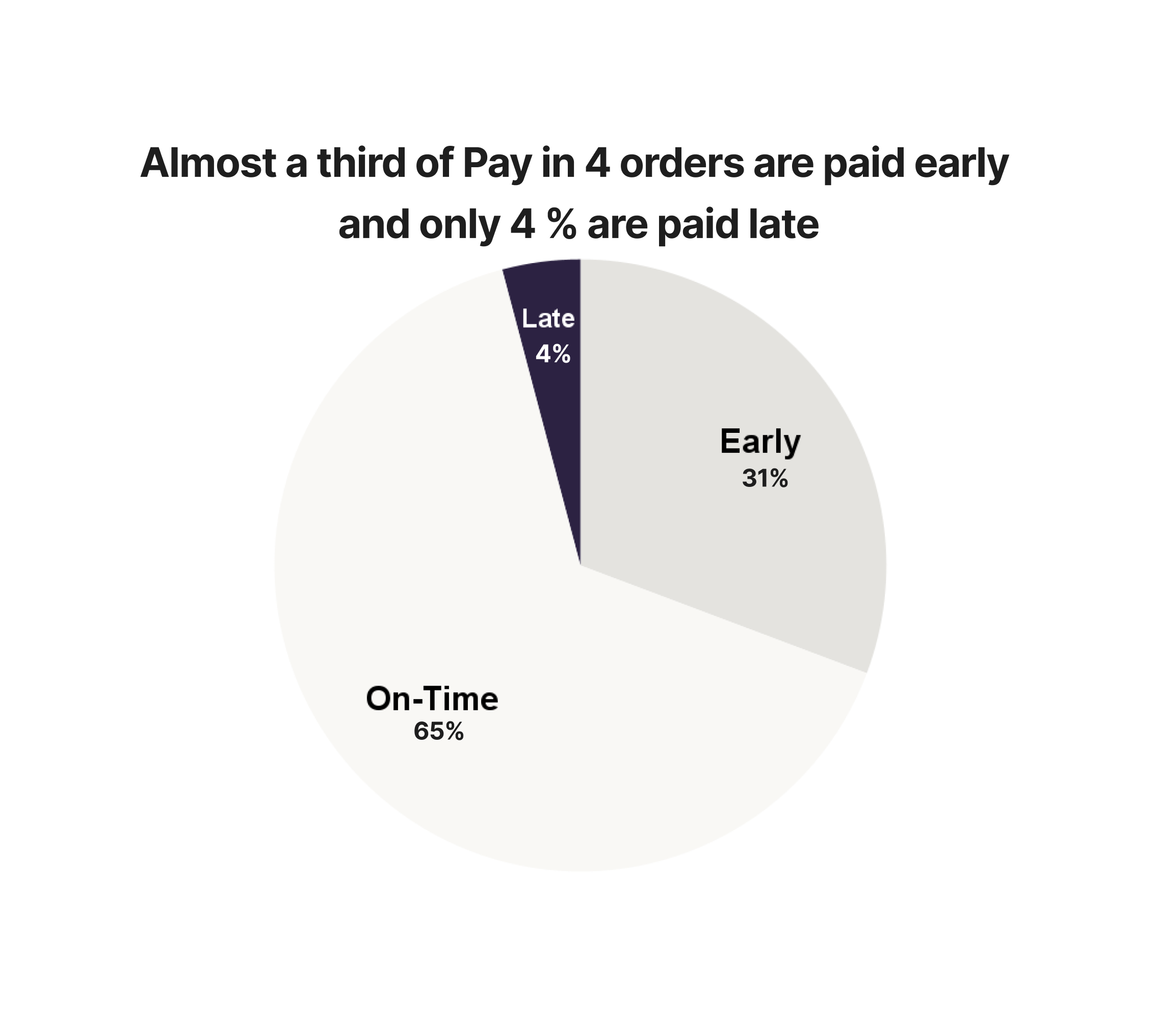

41% of American credit card users are revolving month-to-month (Klarna x Harris Poll survey). In stark contrast, 96% of Klarna’s Pay in 4 customers paid their bills off early or on time, and only 4 % incurred a late fee. 51% of credit card holders now carry revolving debt at 14.8% interest (JD Power)

$1.13T

Credit card debt hit a high of $1.13 trillion in 2023 according to the Federal Reserve Bank of New York. With credit card interest rates as high as 36%, Americans are looking for more sustainable payment alternatives. Compare that with Klarna’s 0% BNPL interest rate.

10%

10% of credit card users have had a credit card payment go into debt collection over the last year (Klarna x Harris Poll survey). In comparison, Klarna’s Pay in 4 orders referred to debt collections have remained below 2.5% over the last year.

>90%

Over 90% of purchases are made with Klarna’s interest-free Pay in 4 option. Compare that to other BNPL providers where the majority of purchases are interest-bearing.

The beginning of fair and sustainable payment methods

Klarna was founded in 2005 and launched in the US in 2019. We exist to make payments more secure, transparent, and frictionless. Unlike credit cards and other BNPL providers which make the majority of their money from consumer interest, our business model is built on charging retailers.

99%

Klarna balance repaid

Less than 1%

Global default rate

31%

pay us back early in the US

¹See payment terms. A higher initial payment may be required for some consumers. CA resident loans made or arranged pursuant to a California Financing Law license. NMLS #1353190.

²A $1,000 purchase might cost $181.04 per month over 6 months at 28.99% APR. Rate ranges from 7.99%-33.99% APR based on creditworthiness and subject to credit approval, resulting in, for example, 12 equal monthly payments of $86.98 at 7.99% APR to $99.46 at 33.99% APR per $1,000 borrowed. Minimum purchase required. A down payment may be required. Estimation of monthly payment excludes potential tax and shipping costs. Monthly financing through Klarna issued by WebBank.

³Exclusions apply. Learn more.

⁴CA resident loans made or arranged pursuant to a California Financing Law license. NMLS # 1353190.

Over 99% of our lending is repaid

Any late payment is a failure on us

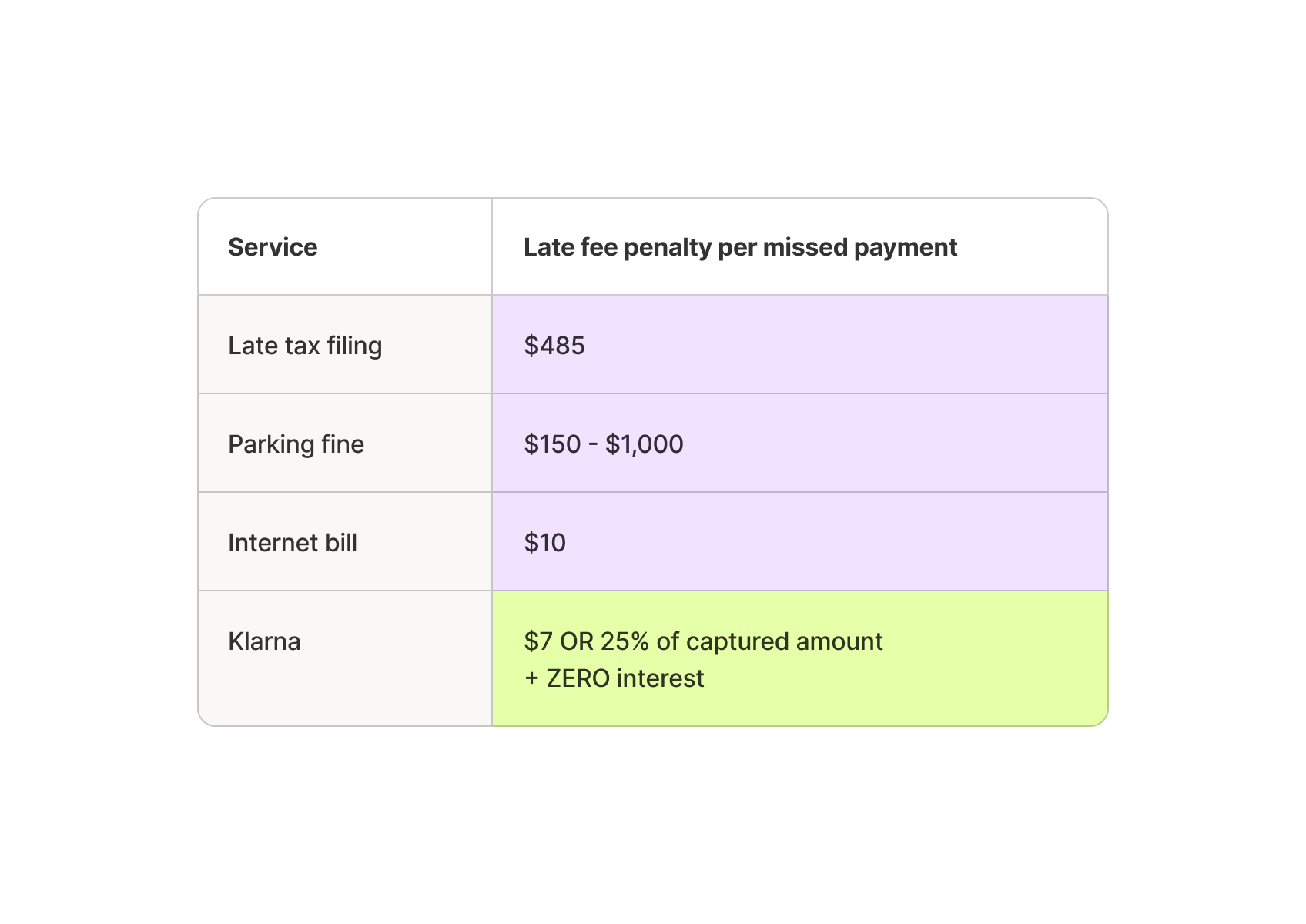

It’s not in our interest to lend to people who can’t pay us back. In fact, this impacts our business negatively. If a customer misses an installment, Klarna notifies them through various personal channels and sends clear follow up reminders to encourage timely payments. We may charge a late fee of up to $7 if any scheduled payment remains unpaid after 10 days, but the total of late fees charged on an order will never exceed 25% of the total purchase amount.

If all four installments have not been paid, we will send a final warning offering the customer an additional grace period of 21 days to settle their outstanding balance. The debt is then passed on to debt collection agencies.

All age groups

Share of US Pay in 4 orders that have received a late fee

Our late fee rates for our most popular payment method, Pay in 4, are declining over time. This is a testament to Klarna’s business model and underscores our consumers pay responsibly and on time.

All age groups

Share of US Pay in 4 orders that have been referred to debt collection

As a result of our rigorous process, the amount of transactions referred to debt collections in the US have declined over time.

Our late fees are significantly less when compared with others

96% of our BNPL purchases are paid early or on time

In 2023 using our Pay in 4 option, 31% of Klarna customers paid their bills off early ahead of the payment due date, and 65% paid on time on the due date.

In 2023, 4% of orders received a late fee, 2% of total orders were paid after receiving a late fee and 2% of orders were handed over to a Debt Collector.

In comparison, 41% of American credit card users are carrying credit card debt month to month (Klarna x Harris Poll survey).

It would take an average American 2.5+ years to pay off their credit card debt if we took the average outstanding US credit card balance ($6,730), average APR rate (20%), and average paid off debt of $270 per month.

More than 95% of our Pay in 4 invoices are paid early or on time

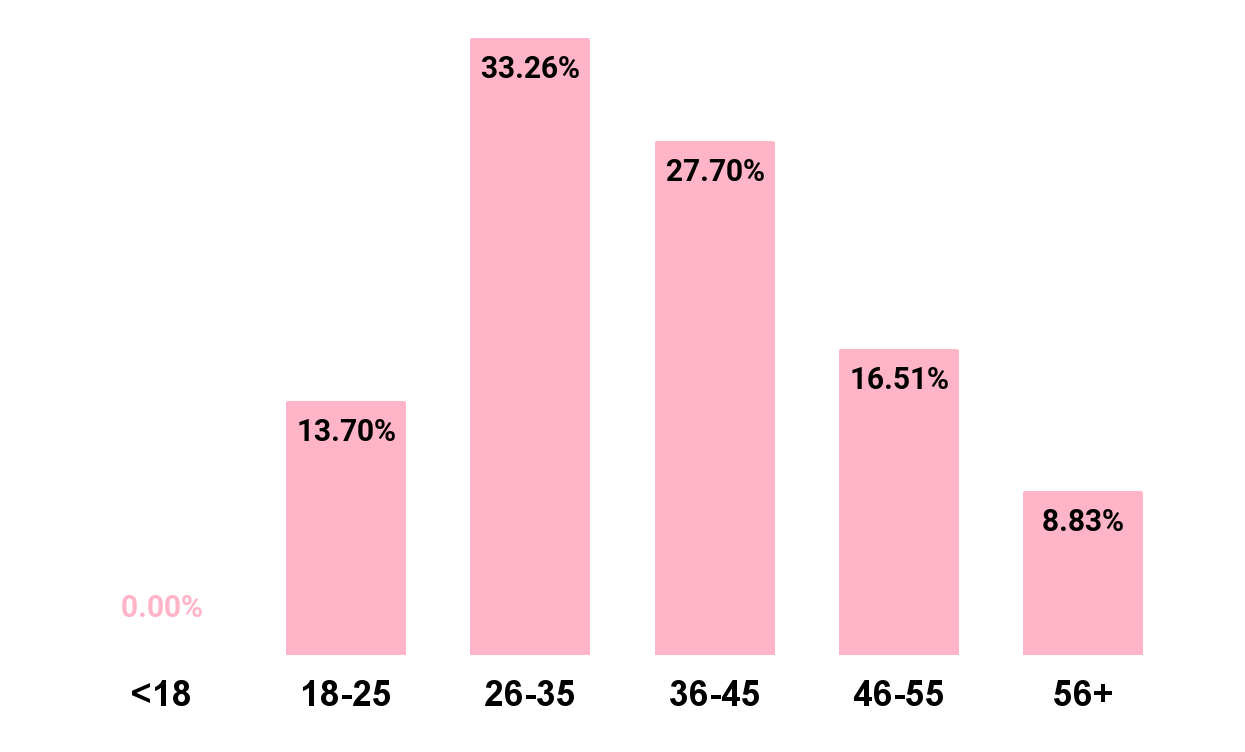

Everyone is using Klarna

People across the world are using Klarna for their everyday spending — both online and in-store, across all types of verticals and industries. There’s no typical Klarna consumer. The average age of a Klarna user in the US is 36, and our fastest growing segment is Boomers (50+).

Shoppers love Klarna

Join 93+ million people who love to shop and pay with Klarna—rated 4.8 out of 5 on the App Store, with over 1.3M reviews.

Available on the App Store

Available on Google Play

Sources

Here are the sources for the externally provided information in each of the sections above

41%

41% of American credit card users are revolving month-to-month (Klarna x Harris Poll survey)

Rest of the sources are quoted in the text

All information comes from Klarna

All information comes from Klarna

All information comes from Klarna and from

The parking fees comes from

Internet bill late fees come from

The calculation of time taken to pay off Credit Card debt is based on:

Average APR coming from

Average monthly paid off credit card debt from

Average outstanding Credit Card balance from

Share of Americans revolving comes from

The current highest credit card interest rate in the US is up to 36% according to

Credit card debt reached 1.13 Trillion USD in 2023 according to the

Average outstanding of 6000 USD comes from

43% of credit card holders do not know the interest rate on their credit cards according to

All information comes from Klarna

All sources are linked to directly from the text